Entertainment Expense Deduction 2024 – Income tax deductions are an essential and legitimate way to reduce your tax burden. Every business or individual has a right to minimize its tax bill. However, sometimes people go too far, taking all . Under the tax law, certain requirements for out-of-town business travel within the United States must be met before you can .

Entertainment Expense Deduction 2024

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coDeducting Meals as a Business Expense

Source : www.thebalancemoney.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comExpanded meals and entertainment expense rules allow for increased

Source : www.plantemoran.comMeals and Entertainment Expenses under the Consolidated

Source : gmco.comMeal and Entertainment Deductions for 2023 2024

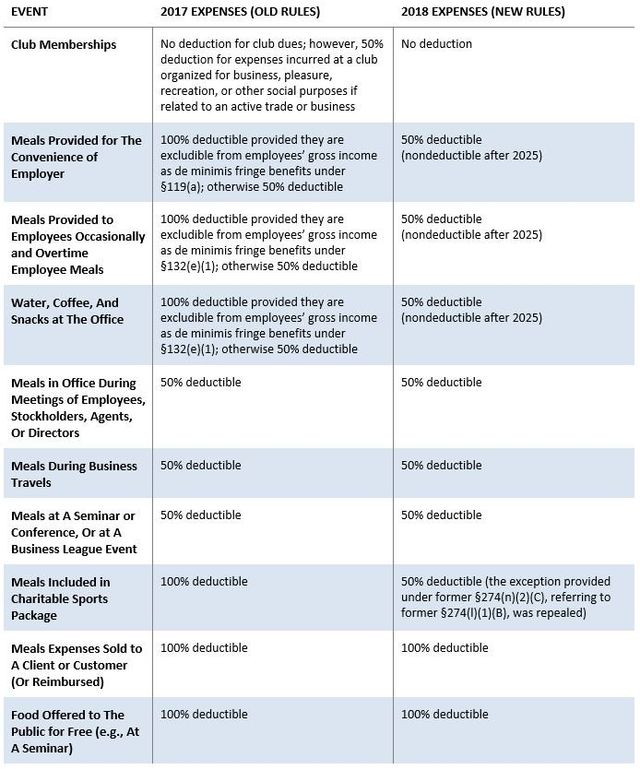

Source : ledgergurus.comMeals & Entertainment Changes Under Tax Reform

Source : www.adminbooks.comMeals and Entertainment Deductions for 2021 22 – Spiegel Accountancy

Source : spiegel.cpaEntertainment Expense Deduction 2024 Meal and Entertainment Deductions for 2023 2024: What Content Creators and Content Creation Companies should consider for tax season and ither accounting areas such as revenue recognition. . This year the standard deduction is $13,850 for someone filing as single or married filing separately. That’s an increase of $900 from last year .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)